- Home

- BONDS

- CALCULATORS

- CAR INSURANCE

- Contact Us

- CYBER INSURANCE

- FIRE INSURANCE

- FIXED DEPOSITS

- HDFC ERGO GROUP MEDICLAIM

- HDFC HEALTH INSURANCE POLICY

- HEALTH INSURANCE

- HOME INSURANCE

- INCOME TAX SLABS & POWER OF COMPOUNDING

- Information

- LIABILITY INSURANCE

- LIFE INSURANCE

- MARINE INSURANCE

- MUTUAL Funds

- NEW INDIA AROGYA PRAGATI PLUS

- NEW INDIA CANCER GUARD

- NEW INDIA FLOATER MEDICLAIM

- NEW INDIA MEDICLAIM POLICY

- NEW INDIA TOP-UP POLICY

- NEW INDIA YUVA BHARAT

- Online Payment

- PERSONAL ACCIDENT INSURANCE

- PERSONAL FINANCE & ESTATE PLANNING

- Products

- Profile

- PROPERTY INSURANCE

- TRAVEL INSURANCE

- Trending

Lalwani Insurance And Investment Consultants

INSURE & BE SECURE

Mutual Funds

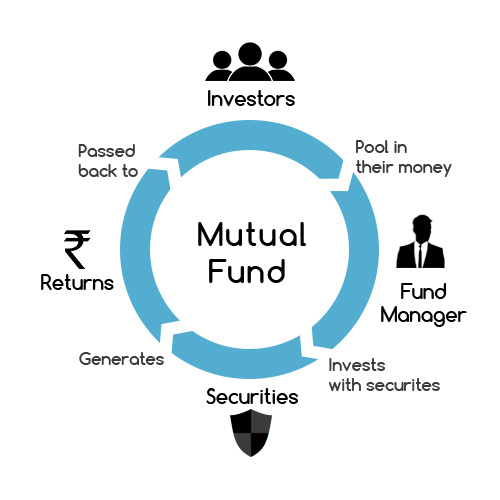

Mutual funds are a type of certified managed combined investment scheme that gathers money from many investors to buy securities. There is no such accurate definition of mutual funds, however, the term is most commonly used for collective investment schemes that are regulated and available to the general public and open-ended in nature. Hedge funds are not considered any type of mutual funds. Mutual funds are identified by their principal investments. They are the 4th largest category of funds that are also known as money market funds, bond or fixed-income funds, stock or equity funds, and hybrid funds. Funds are also categorized as index-based or actively managed.

The fund manager is also known as the fund sponsor or fund management company. The buying and selling of the fund’s investments in accordance with the fund’s investment is the objective. A fund manager has to be a registered investment advisor. The same fund manager manages the funds and has the same brand name which is also known as a fund family or fund complex.

As long as mutual comply with requirements that are established in the internal revenue code, they will not be taxed on their income. Clearly, they must expand their investments, limit the ownership of voting securities, disperse most of their income to their investors annually and earn most of their income by investing in securities and currencies.

Mutual funds can pass taxable income to their investors every year. The type of income that they earn remains unchanged as it gets transferred to the shareholders. For e.g., mutual fund distributors of dividend income are described as dividend income by the investor.

Mutual funds invest in various kinds of securities. The various types of securities that a particular fund may invest in are mentioned in the fund’s prospectus, which explains the fund’s investments objective, its approach, and the permitted investments. The objective of the investment describes the kind of income that the fund is looking for. For e.g., a “capital appreciation” fund generally looks to earn most of its returns from the increase in prices of the securities it holds rather than from a dividend or the interest income. The approach of the investment describes the criteria that the fund manager may have used to select the investments for the fund.

Open ended funds

An open-end fund is a diversified portfolio of pooled investor money that can issue an unlimited number of shares. The fund sponsor sells shares directly to investors and redeems them as well.

Hybrid funds

Hybrid funds are mutual funds or exchange-traded funds (ETFs) that invest in more than one type of investment security, such as stocks and bonds.

Close Ended funds

A closed-end fund (CEF) or closed-ended fund is a collective investment model based on issuing a fixed number of shares which are not redeemable from the fund.

Income funds

Income funds are mutual funds or ETFs that prioritize current income, often in the form of interest or dividend paying investments.

Debt funds

A bond fund or debt fund is a fund that invests in bonds or other debt securities. Bond funds can be contrasted with stock funds and money funds.

Sector Funds

A sector fund is a fund that invests solely in businesses that operate in a particular industry or sector of the economy. Sector funds are commonly structured as mutual funds or exchange-traded funds

Equity funds

An equity fund is a mutual fund that invests principally in stocks. It can be actively or passively (index fund) managed. Equity funds are also known as stock funds.

Real asset funds

Real assets are physical assets that have an intrinsic worth due to their substance and properties. Real assets include precious metals, commodities, real estate, land, equipment, and natural resources.